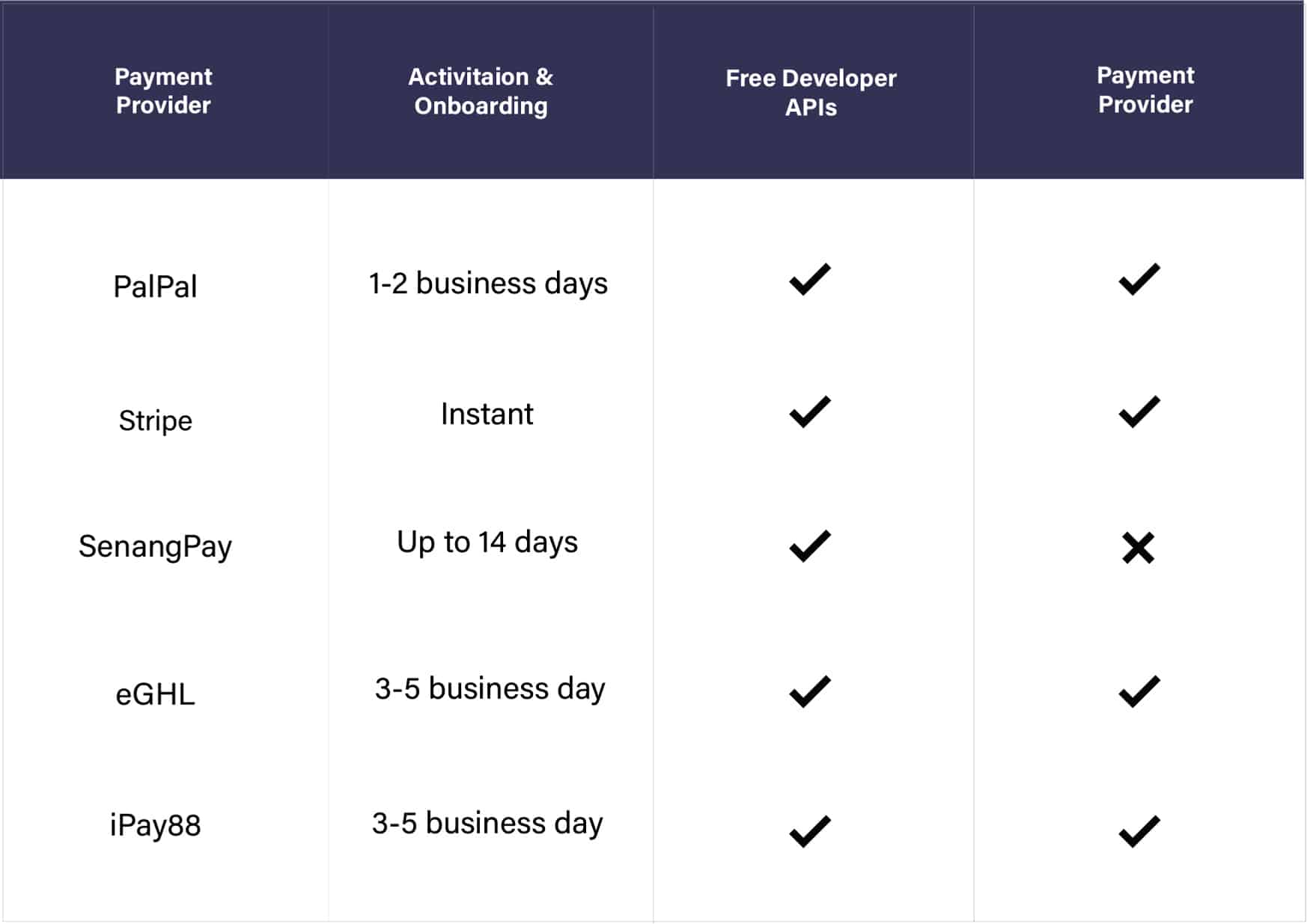

An e-commerce payment gateway is necessary for online sales. In the end, how do you pick which payment gateway is appropriate for your company and why?

SenangPay, iPay88, and PayPal are just a few of the major payment gateways in Malaysia that we’ve compared in this short and sweet comparison.Continue reading for more information!

PayPal provides a wide range of services, including digital wallets and loans, but the eCommerce behemoth is best known for its user-friendly payment processing.

Pros:

✅ It accepts over 25 currencies and is available in over 200 countries.

✅ Allows for payment in instalments.

✅ PayPal Seller Protection is provided.

Cons:

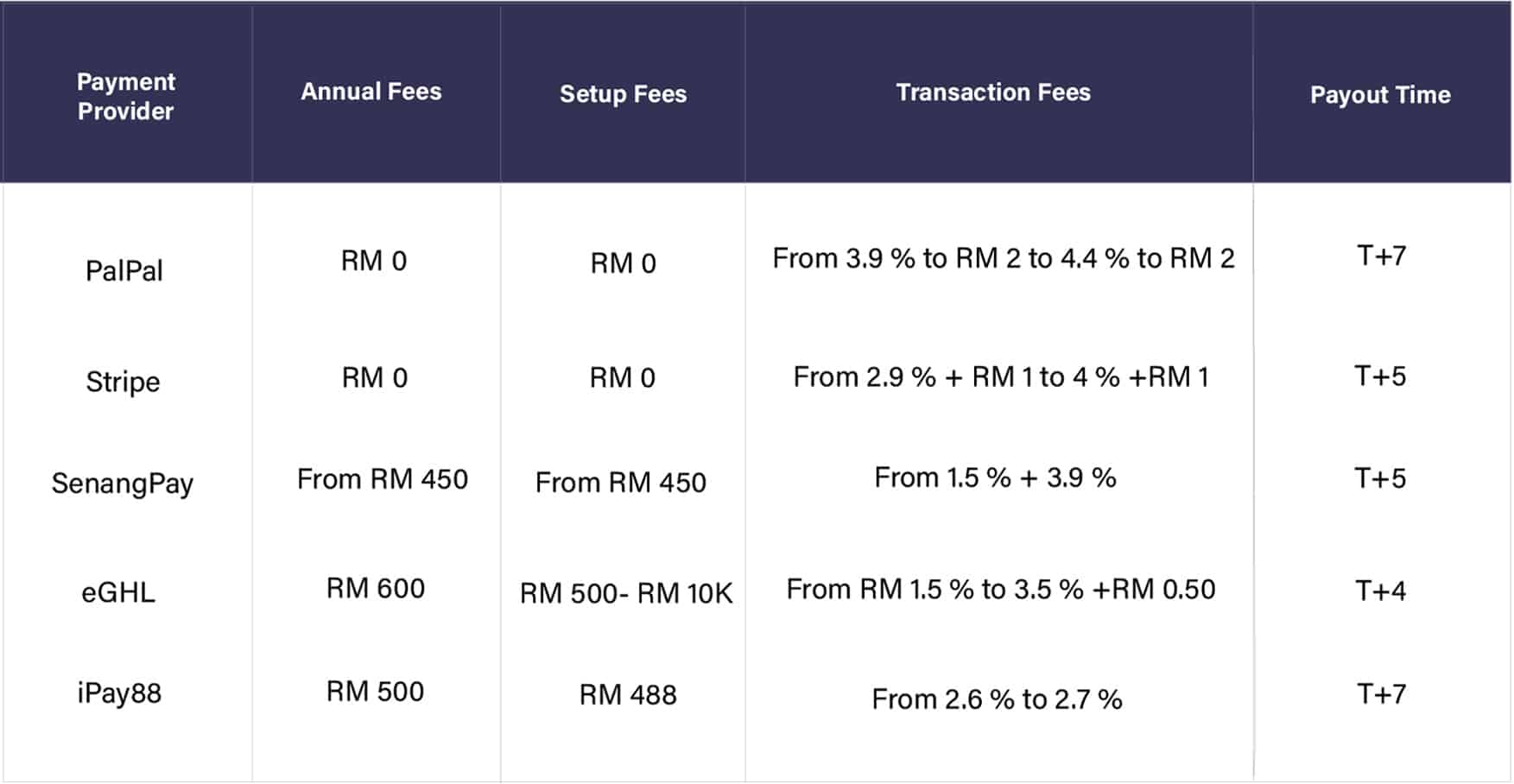

❌ Has some of the highest transaction fees, ranging between 3.9 percent and RM 2 per transaction.

❌ Doesn’t accept local payment methods like as FPX, Alipay, or GrabPay.

Stripe is an all-in-one payment processor with the ability to process payments and act as a payment gateway. With the aid of Stripe, your business may collect credit card payments from your campaign through the internet and have the money sent immediately into your bank account.

Pros:

✅ No yearly fees.

✅ Quick onboarding.

✅ 130+ currencies accepted.

Cons:

❌ Fees are high.

❌ No free accounting or business software.

❌ Some payment alternatives need coding skills.

senangPay is a relatively new Payment Gateway provider, but their application can be done through their website which is very convenient.

Pros:

✅ Multiple payment methods are supported, including social media and email.

✅ Multi-currency, e-wallets, recurring payments, and bulk payments are all supported.

Cons:

❌ Annual fees start at RM450.

❌ Setting up might take up to 14 days.

❌ Does not work with Shopify.

With the help of eGHL, online retailers and e-commerce websites may now take a wide range of safe online payment choices, including FPX, MasterCard, Visa, Malaysian banks’ internet banking payments, MCash, UnionPay and Alipay.

Pros:

✅ Installment and regular payment alternatives.

✅ Can put limitless click-to-pay buttons on website or social media.

✅ Over 100 payment methods.

Cons:

❌ Fees yearly, setup, and transaction.

❌ No free accounting or business software.

❌ Lacks integration with major e-commerce platforms.

Since 2006, more than 10,000 businesses locally and abroad have successfully used iPay88’s e-commerce and online payment services.

Pros:

✅ Recurring payments are available.

✅ Over 37 payment methods are supported.

Cons:

❌ Annual, setup, and transaction fees are charged.

❌ Payment options are limited. Does not accept international Visa, Mastercard, or Alipay.

Having the proper payment gateway partner is like picking the ideal cashier in a supermarket. They guarantee your clients are pleased and that all of the money is received and correctly handled.

However, not all payment gateways are roughly the same. Choose the one that best matches your company model and whatever elements you want to offer to your clients’ buying experiences.

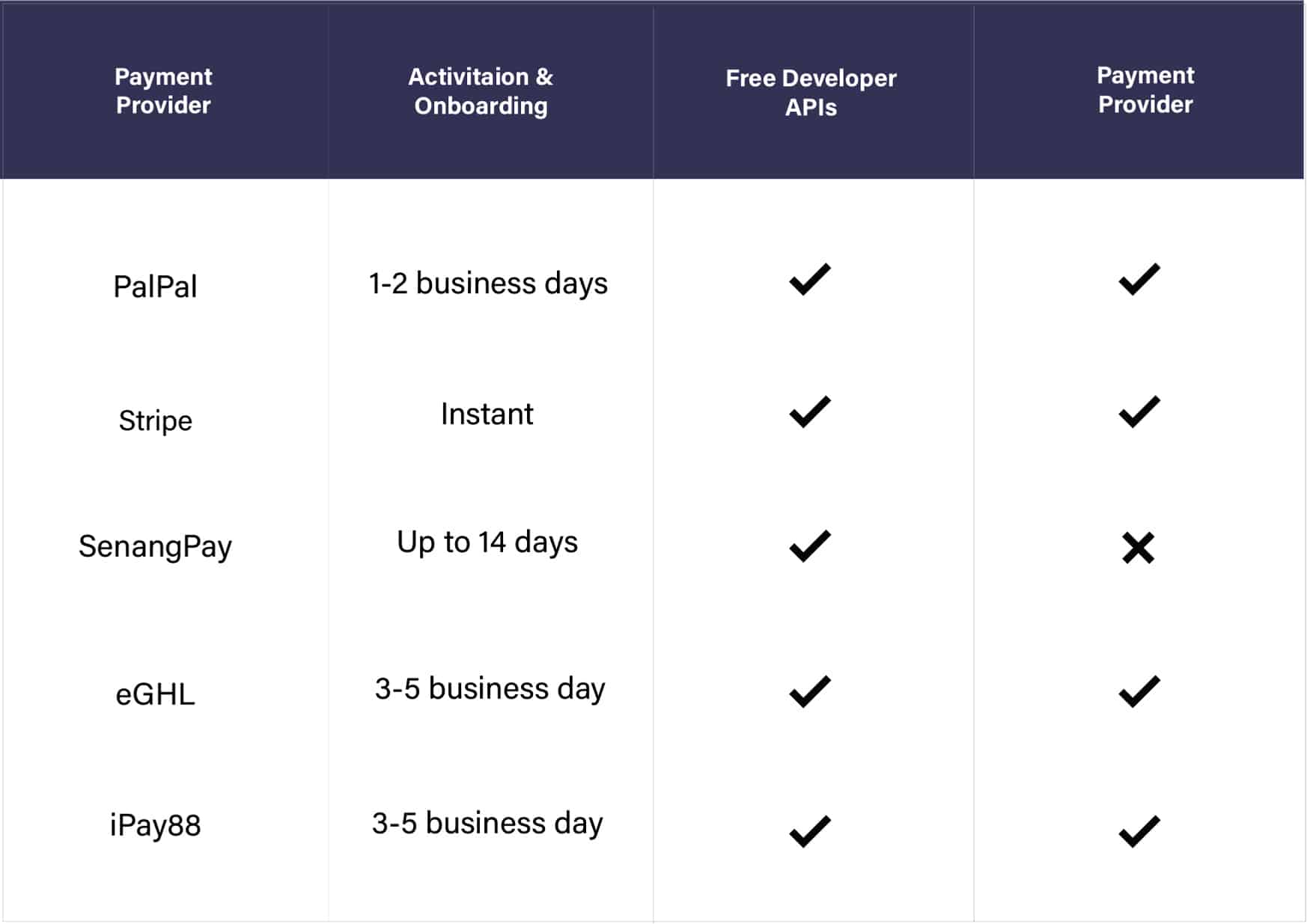

An e-commerce payment gateway is necessary for online sales. In the end, how do you pick which payment gateway is appropriate for your company and why?

SenangPay, iPay88, and PayPal are just a few of the major payment gateways in Malaysia that we’ve compared in this short and sweet comparison.Continue reading for more information!

PayPal provides a wide range of services, including digital wallets and loans, but the eCommerce behemoth is best known for its user-friendly payment processing.

Pros:

✅ It accepts over 25 currencies and is available in over 200 countries.

✅ Allows for payment in instalments.

✅ PayPal Seller Protection is provided.

Cons:

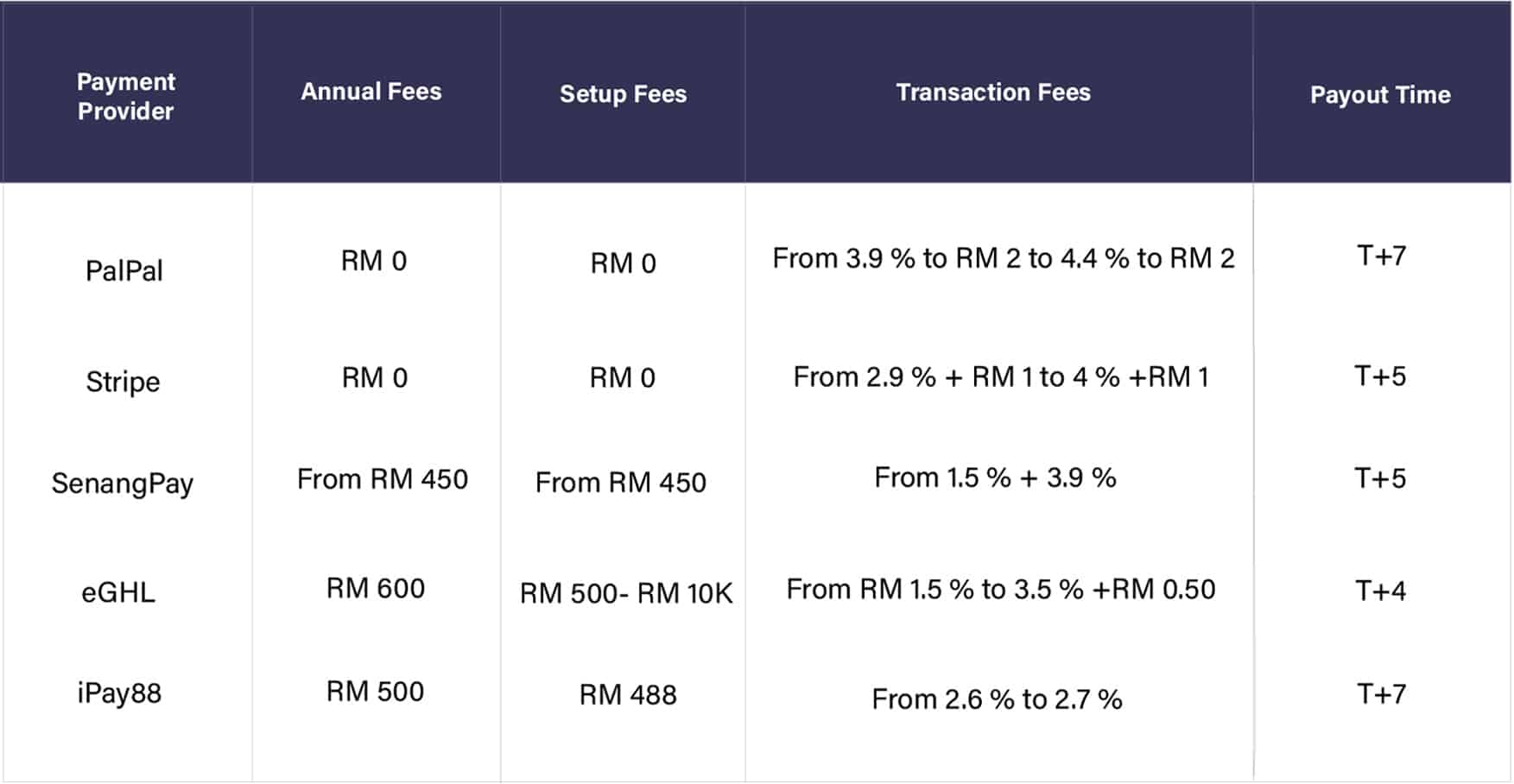

❌ Has some of the highest transaction fees, ranging between 3.9 percent and RM 2 per transaction.

❌ Doesn’t accept local payment methods like as FPX, Alipay, or GrabPay.

Stripe is an all-in-one payment processor with the ability to process payments and act as a payment gateway. With the aid of Stripe, your business may collect credit card payments from your campaign through the internet and have the money sent immediately into your bank account.

Pros:

✅ No yearly fees.

✅ Quick onboarding.

✅ 130+ currencies accepted.

Cons:

❌ Fees are high.

❌ No free accounting or business software.

❌ Some payment alternatives need coding skills.

senangPay is a relatively new Payment Gateway provider, but their application can be done through their website which is very convenient.

Pros:

✅ Multiple payment methods are supported, including social media and email.

✅ Multi-currency, e-wallets, recurring payments, and bulk payments are all supported.

Cons:

❌ Annual fees start at RM450.

❌ Setting up might take up to 14 days.

❌ Does not work with Shopify.

With the help of eGHL, online retailers and e-commerce websites may now take a wide range of safe online payment choices, including FPX, MasterCard, Visa, Malaysian banks’ internet banking payments, MCash, UnionPay and Alipay.

Pros:

✅ Installment and regular payment alternatives.

✅ Can put limitless click-to-pay buttons on website or social media.

✅ Over 100 payment methods.

Cons:

❌ Fees yearly, setup, and transaction.

❌ No free accounting or business software.

❌ Lacks integration with major e-commerce platforms.

Since 2006, more than 10,000 businesses locally and abroad have successfully used iPay88’s e-commerce and online payment services.

Pros:

✅ Recurring payments are available.

✅ Over 37 payment methods are supported.

Cons:

❌ Annual, setup, and transaction fees are charged.

❌ Payment options are limited. Does not accept international Visa, Mastercard, or Alipay.

Having the proper payment gateway partner is like picking the ideal cashier in a supermarket. They guarantee your clients are pleased and that all of the money is received and correctly handled.

However, not all payment gateways are roughly the same. Choose the one that best matches your company model and whatever elements you want to offer to your clients’ buying experiences.